Logistics

Warehousing & Fulfillment

Transportation

E-commerce

E-commerce Fulfillment Services

Lease & Maintenance

Semi Trucks

Supply Chain Technology

Logistics

E-commerce

Lease & Maintenance

Buy Used Trucks

[Updated post from September 8, 2022]

Holiday e-commerce and retail is the time of year when demand – and expectations – for a seamless customer experience skyrocket. Meeting these expectations from both new and existing customers entails a lot of investment, but also big rewards for the businesses that can get it right.

If you want to boost your ecommerce holiday sales this year, you'll need to pay close attention to consumer sentiment and all the ways that shoppers are trying to do more with less. Luckily for you, we've put together this round-up of top holiday shopping predictions for 2023, so you know exactly where to dedicate your efforts.

Let's begin!

Inflation continues to be the big economic story of the moment, and retailers need to pay close attention to how this is going to impact holiday shopping behavior and retail sales during peak.

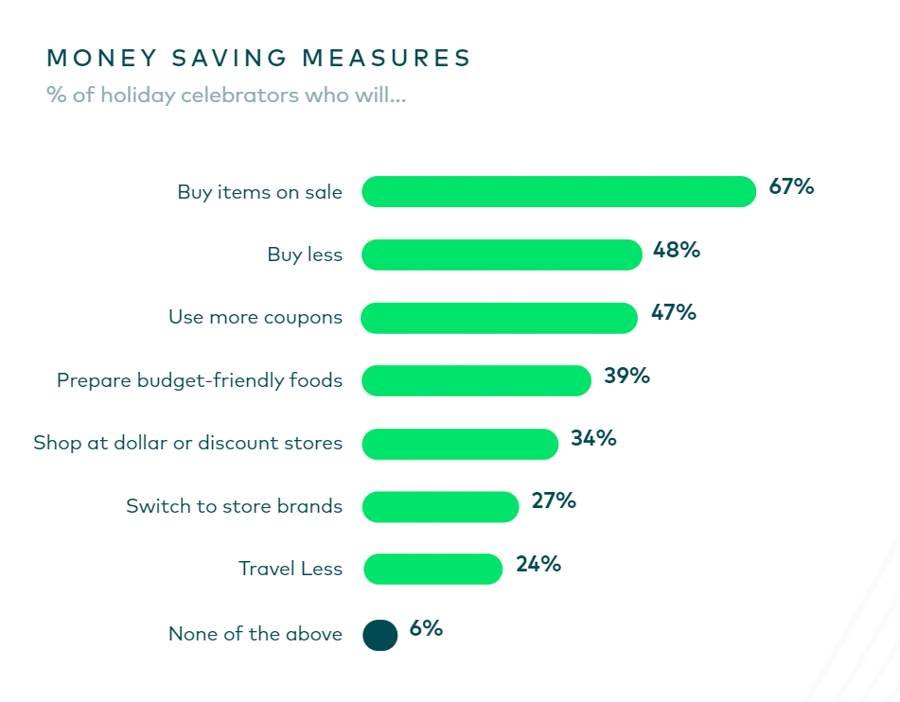

Holiday sales increased by just 5.3% in 2022, as lower consumer spending set in and product prices increased. As we head closer to the 2023 holiday season, major retailers are continuing to report much softer earnings, with high interest rates still dampening consumer interest in discretionary products.According to Numerator's 2023 holiday shopping survey, 54% of consumers say that inflation will have a moderate or significant impact on their holiday spending this year. By far the most popular strategy to cut costs is buying on-sale merchandise, as reported by 67% of respondents:

These discount-driven shopping behaviors are causing anxious retailers to bring forward promotions and inventory traditionally reserved for the fourth quarter, with the likes of Amazon, Walmart, and Target already starting to spotlight holiday merchandise in sales events in a bid to increase consumers' spending. This has had the effect of bringing the holiday season forward beyond the traditional Black Friday Cyber Monday kick-off, with customers getting into the holiday mindset as early as October in a bid to secure the best deals on holiday purchases.

Walmart priming shoppers to get 'holiday ready' with their latest home capsule collection.

An earlier start to the holiday shopping season means that brands need to be ready to cater to their customers' in-store and online shopping needs. If your seasonal inventory hasn't arrived yet, there are still options. For example, changing up your messaging on your website and social media channels can be enough to get your followers thinking about how close at hand the 2023 holiday shopping season is, as shown here by Walmart.

The time-sensitive nature of the holiday season can make it difficult for consumers to manage cash flow while also snapping up sought-after products. Buy Now, Pay Later (BNPL) offers a convenient solution by enabling shoppers to set up deferred payment plans while receiving their holiday purchases upfront.

In the current inflationary environment, the value proposition of BNPL is extremely compelling. The recent Back to School spending spree has seen considerable numbers of consumers relying on BNPL programs to afford goods such as textbooks and laptops. With back-to-school spending forecast to reach $135 billion in 2023, this sets the tone for continuing use as the holiday season draws closer.

BNPL providers are now embedded in more checkouts than ever before, with 54% of retailers in the Top 1000 now offering a least one BNPL option to their customers. Last year BNPL orders during the 2022 holidays rose 4% YOY compared with 2021, partly thanks to 71% of BNPL users making over $100,000 increasing their usage over the past twelve months.

So, it's safe to assume that the upcoming holiday shopping season will see a significant boost in the use of BNPL. Far from only attracting the low-income consumer, the zero-cost nature of BNPL is also capturing more affluent shoppers who want to avoid purchasing items upfront when they don't need to.

The holiday season traditionally sees return rates spike to annual highs as shoppers return unwanted gifts. According to the National Retail Federation, holiday season return rates during 2022 reached 17.9% of total sales during the period, amounting to millions in lost revenue. Moreover, 2022 also saw holiday return fraud persist, with retailers losing $10.40 to return fraud for every $100 accepted in returned merchandise.

As a result, many retailers are now tightening return policies as the holiday shopping season draws closer to reduce fraud and influence customer behavior away from returns. 88% of global retailers are planning to make their return policies stricter this year, according to a recent Salesforce survey. Common policy changes include restocking fees, shorter return windows, restricting what types of products are allowed to be returned, and even charging for returns.

This shift toward policing returns brings an end to a more laissez-faire approach that has dominated retail for the past few years. The COVID-19 pandemic saw retailers relax return policies in a bid to bolster consumer confidence when shopping online, but sometimes at a significant cost to their bottom line. With in-store retail making a significant comeback, merchants are pulling back on generous policies that increase fraud risk.

Unsurprisingly, most consumers are unhappy with this change. A customer survey by Blue Yonder found that 69% of consumers were aware of tighter return policies, while 60% found these changes to be inconvenient and unfair. This provides an opportunity for merchants to stand out from the crowd by maintaining more flexible returns in a bid to increase customer acquisition.

With the holiday season responsible for a large percentage of retail profits, it's not surprising that brands are looking for new ways to give themselves an edge over competitors. The deployment of generative AI solutions and machine learning has offered new ways for retailers to support a range of critical functions, from customer service and demand forecasting to content creation.

In fact, 26% of retailers say they plan to increase investment in AI technologies in 2023 compared to 2022, while 44% said it would be important to improving online conversions. The Honeywell AI in Retail survey found the top three reasons for deploying AI technologies were:

Spikes in customer interactions and order volumes have traditionally stretched customer care capabilities during the holiday season, with support teams unable to effectively scale as website and store visits increase. This can lead to brands missing out on valuable sales opportunities due to delays in answering inquiries or responding to customer reviews. Moreover, the need to populate hundreds if not thousands of unique product listings in time for the holiday shopping season creates a significant bottleneck for internal teams. Deploying AI solutions during periods of high engagement is a way to positively influence consumer behavior and encourage additional purchases.

As customer acquisition costs rise, retailers are having to contend with an online environment that’s more hostile to growth than previous holiday shopping seasons. As well as rising inflation impacting operational costs, growing saturation in the marketplace is making it harder than ever for brands to get in front of the right audience.

This uncertain climate is making it essential for brands to deliver engaging shopping experiences that are tailored to individual customer needs. When 75% of shoppers are willing to pay more for personalized online shopping experiences, understanding customer needs at a granular level is no longer optional.

The targeted collection of first-party customer data is central to bringing personalization to life. 66% of retail brands say they are trying to get to know their customers better before the holiday season via data collection. With inflation concerns impacting customer spending, serving customers with the right product or offer at the right time is the difference between securing a sale or losing consumers to competitors.